Orthopedic Software Market

Orthopedic Software Market by Application (Sports Medicine, Joint Replacement, Fracture Management, Deformity Correction, and Other) by Product (Practice Management, Digital Orthopedic Templating, Electronic Health Record, and Others) – Global Trends, Industry Size, Share, Growth and Forecast, 2019-2025 Update Available - Forecast 2025-2031

Orthopedic Software Market is expected to grow at a moderate rate during the forecast period 2019-2025. Orthopedic software has been gaining significant importance among orthopedic professionals. This enables professionals to deal with a significant amount of lab test results, particularly imaging at the time of diagnosis and for follow-ups to monitor the patient’s progress during recovery. A broad range of software are used for orthopedic applications, such as practice management software, EHR, and PACS (picture archiving and communication systems). The software deals with day-to-day operations of medical practice, such as scheduling appointments, capturing patient demographics, performing medical billing task and generating reports.

Furthermore, the factors that are contributing to the demand for orthopedic software include rising demand for minimally invasive procedures and the rising number of joint replacement procedures. For instance, as per American Joint Replacement Registry (AJRR), in the US, in 2017, the number of hip and knee replacement procedures performed were 860,080, from 654 institutions and 4,755 surgeons. Moreover, as per the Canadian Joint Replacement Registry, during the period (2014-2015), the number of hip replacements performed were 51,272 in Canada. During the period (2009-2010), the number of hip replacements performed was 42,713. This represents a significant growth of 20% in hip replacements in Canada. To perform joint replacement surgeries, orthopedic software provides critical information to the surgeons. As a result, this enables surgeons to perform joint replacement procedures with enhanced alignment and greater precision. With orthopedic software-guided surgery, the surgeons can place hip and knee implants along with products that are intended to gain more confidence and precision. Hence, orthopedic software allows accurate positioning of the implants and better clinical outcomes.

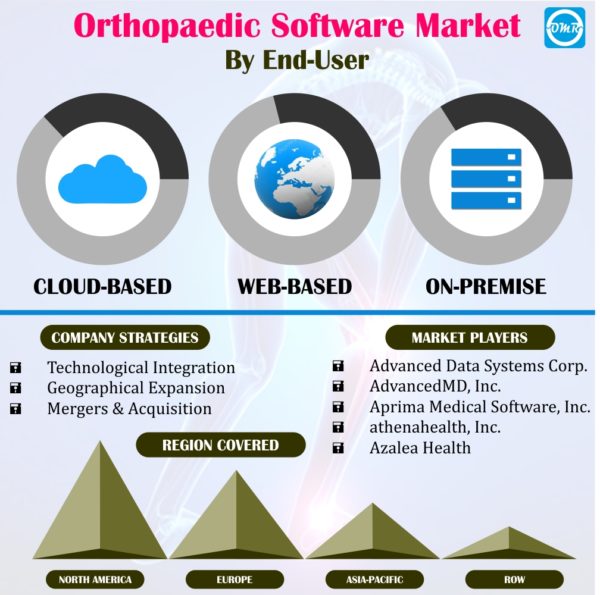

The global orthopedic software market is segmented into application, product, and mode of delivery. Based on application, the market is further segmented into a joint replacement, fracture management, deformity correction, and others. Based on product, the market is further classified into practice management, digital orthopedic templating, EHR, PACS, and others. The EHR system supports physicians to develop custom treatment plans for particular medical conditions by setting up prescriptions, referral letters, patient education and holds more with an only single click. The platform provides access to aggregated information of the patients in one location. As a result, it is highly beneficial for healthcare providers to operate patients in emergency conditions. It holds the functionality of clinical viewing and reporting workflow. The features of EHR software include appointment management, reporting and analytics, e-prescription, billing management, scheduling, patient history and so on. Moreover, EHR incentive programs by Centers for Medicare & Medicaid Services encourages the adoption of EHR among healthcare providers for better access to patients’ information. This, in turn, is supporting the demand for EHR across a wide range of medical specialties and thereby contributing to the adoption of EHR in orthopedics. Based on the mode of delivery, the market is further segmented into cloud-based, web-based and on-premise.

Geographically, the global orthopedic software market is segmented into four major regions, such as North America, Europe, Asia-Pacific, and RoW. North America was anticipated to hold a significant share in the market due to government incentives for adoption of EHR solutions. Additionally, Asia-Pacific is expected to witness significant growth due to increasing demand for minimally invasive procedures.

The major players in the market comprise Brainlab AG, Merge Healthcare, Inc., Modernizing Medicine, Inc., Materialise N.V., Medtrat, Inc., and CureMD Healthcare. These companies are adopting various strategies, such as merger and acquisitions, product launches and partnerships to expand market share and presence across the globe. For instance, in March 2018, Modernizing Medicine, Inc. and Ambra Health declared collaboration to accelerate the orthopedics specific EHR system, EMA with advanced PACS connectivity. This will enable orthopedic surgeons to achieve direct connectivity between EMA and their images from practically all PACS system. The Ambra zero footprint, HTML5 Viewer can be utilized through the web and provides freedom to access images from anywhere. The partnership will enable to solve two major concerns in the healthcare industry, such as lowering costs and improved patient access. The platforms, EMA and Ambra can support healthcare providers to optimize staff time and streamline processes while improving their image management strategy.

Research methodology:

The market study of the global orthopedic software market is incorporated by extensive primary and secondary research conducted by the research team at OMR. Secondary research has been conducted to refine the available data to breakdown the market in various segments, derive total market size, market forecast, and growth rate. Different approaches have been worked on to derive the market value and market growth rate. Our team collects facts and data related to the market from different geography to provide a better regional outlook. In the report, the country-level analysis is provided by analyzing various regional players, regional tax laws and policies, consumer behavior and macro-economic factors. Numbers extracted from Secondary research have been authenticated by conducting proper primary research. It includes tracking down key people from the industry and interviewing them to validate the data. This enables our analyst to derive the closest possible figures without any major deviations in the actual number. Our analysts try to contact as many executives, managers, key opinion leaders, and industry experts. Primary research brings authenticity in our reports.

Secondary sources include:

- Financial reports of companies involved in the market.

- Authentic public databases such as AJRR, The Japanese Society for Replacement Arthroplasty and so on.

- Whitepapers, research-papers, and news blogs.

- Company websites and their product catalog.

The report is intended for government and private companies for overall market analysis and competitive analysis. The report provides in-depth analysis on market size, intended quality of the service preferred by consumers. The report will serve as a source for 360-degree analysis of the market thoroughly integrating different models.

Market segmentation:

- Global Orthopedic software Market Research and Analysis by Application

- Global Orthopedic software Market Research and Analysis by Product

- Global Orthopedic software Market Research and Analysis by Mode of Deployment

The report covers:

- Comprehensive research methodology of the global orthopedic software market.

- This report also includes a detailed and extensive market overview with key analyst insights.

- An exhaustive analysis of macro and micro factors influencing the market guided by key recommendations.

- Analysis of regional regulations and other government policies impacting the global orthopedic software market.

- Insights about market determinants which are stimulating the global orthopedic software market.

- Detailed and extensive market segments with regional distribution of forecasted revenues.

- Extensive profiles and recent developments of market players.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Brainlab AG

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Merge Healthcare, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Materialise N.V.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Medstrat, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. CureMD Healthcare

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Orthopedic Software Market by Application

5.1.1. Joint Replacement

5.1.2. Fracture Management

5.1.3. Deformity Correction

5.1.4. Others (Pediatric Orthopedic Assessment)

5.2. Global Orthopedic Software Market by Product

5.2.1. Practice Management

5.2.2. Digital Orthopedic Templating

5.2.3. Electronic Health Record (EHR)

5.2.4. Picture Archiving and Communication Systems (PACS)

5.2.5. Others (Revenue Cycle Management and Patient Engagement)

5.3. Global Orthopedic Software Market by Mode of Deployment

5.3.1. Cloud-Based

5.3.2. Web-Based

5.3.3. On-Premise

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Advanced Data Systems Corp.

7.2. AdvancedMD, Inc.

7.3. Aprima Medical Software, Inc.

7.4. athenahealth, Inc.

7.5. Azalea Health

7.6. Bizmatics, Inc.

7.7. Brainlab AG

7.8. CareCloud Corp.

7.9. Carestream Health, Inc.

7.10. Compulink Healthcare Solutions

7.11. CureMD Healthcare

7.12. DICOM Grid, Inc. (dba Ambra Health)

7.13. drchrono, Inc.

7.14. Exscribe, Inc.

7.15. Greenway Health, LLC

7.16. iSALUS Healthcare

7.17. Kareo, Inc.

7.18. Konica Minolta Healthcare Americas, Inc.

7.19. Materialise N.V.

7.20. Medsphere Systems Corp.

7.21. Medstrat, Inc.

7.22. Merge Healthcare, Inc.

7.23. Modernizing Medicine, Inc.

7.24. NextGen Healthcare, Inc.

7.25. Novarad Corp.

7.26. ScImage, Inc.

7.27. Sectra AB

1. GLOBAL ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

2. GLOBAL JOINT REPLACEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL FRACTURE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL DEFORMITY CORRECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL OTHERS APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

7. GLOBAL PRACTICE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL DIGITAL ORTHOPEDIC TEMPLATING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL EHR MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL PACS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL OTHER PRODUCT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

13. GLOBAL CLOUD-BASED MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL WEB-BASED MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL ON-PREMISE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. NORTH AMERICAN ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

20. NORTH AMERICAN ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

21. EUROPEAN ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. EUROPEAN ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

23. EUROPEAN ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

24. EUROPEAN ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

28. ASIA-PACIFIC ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

29. REST OF THE WORLD ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

30. REST OF THE WORLD ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

31. REST OF THE WORLD ORTHOPEDIC SOFTWARE MARKET RESEARCH AND ANALYSIS BY MODE OF DEPLOYMENT, 2018-2025 ($ MILLION)

1. GLOBAL ORTHOPEDIC SOFTWARE MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

2. GLOBAL ORTHOPEDIC SOFTWARE MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

3. GLOBAL ORTHOPEDIC SOFTWARE MARKET SHARE BY MODE OF DEPLOYMENT, 2018 VS 2025 (%)

4. GLOBAL ORTHOPEDIC SOFTWARE MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US ORTHOPEDIC SOFTWARE MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA ORTHOPEDIC SOFTWARE MARKET SIZE, 2018-2025 ($ MILLION)

7. UK ORTHOPEDIC SOFTWARE MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE ORTHOPEDIC SOFTWARE MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY ORTHOPEDIC SOFTWARE MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY ORTHOPEDIC SOFTWARE MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN ORTHOPEDIC SOFTWARE MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE ORTHOPEDIC SOFTWARE MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA ORTHOPEDIC SOFTWARE MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA ORTHOPEDIC SOFTWARE MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN ORTHOPEDIC SOFTWARE MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC ORTHOPEDIC SOFTWARE MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD ORTHOPEDIC SOFTWARE MARKET SIZE, 2018-2025 ($ MILLION)